Fasb gaap depreciation calculator

Divide 100 by the number of years in the asset life and then multiply by 2 to find the depreciation rate. Ad QuickBooks Financial Software For Businesses.

What Is Straight Line Depreciation Guide Formula Netsuite

Remember the factory equipment is.

. Guidance For Major Standards. Show All in One. Loans - FASB 91 fee income.

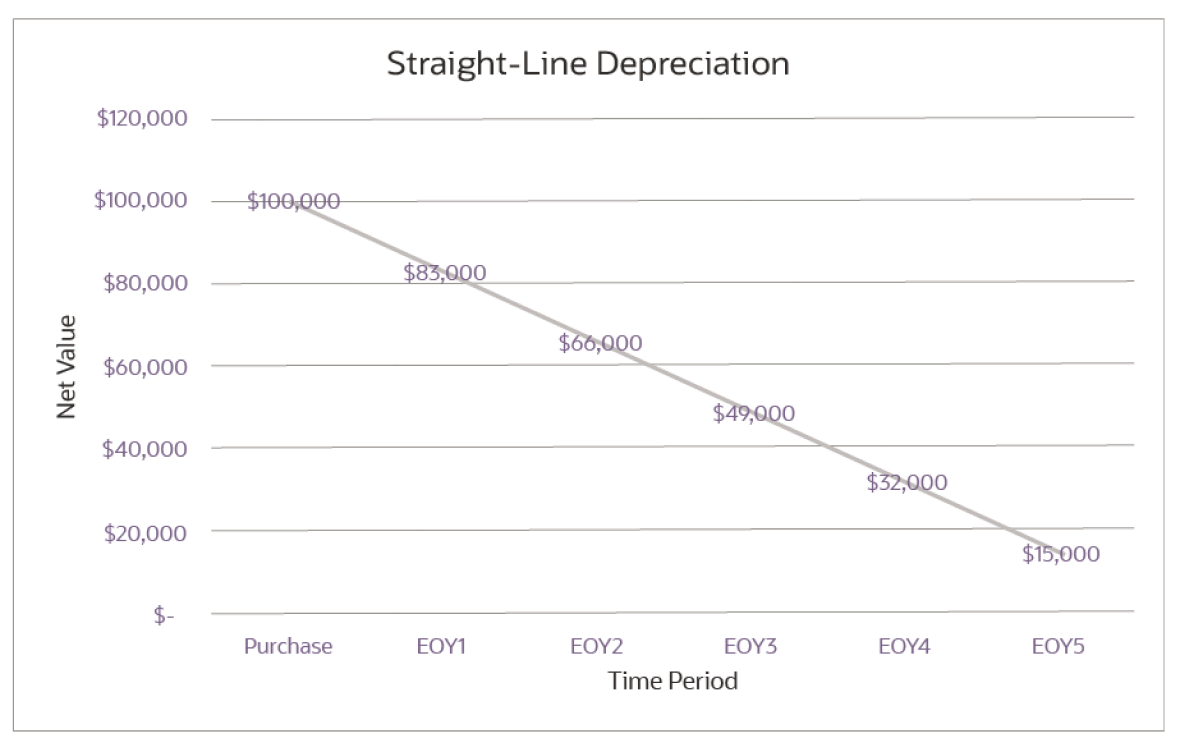

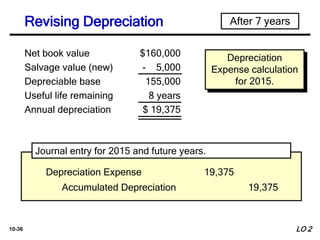

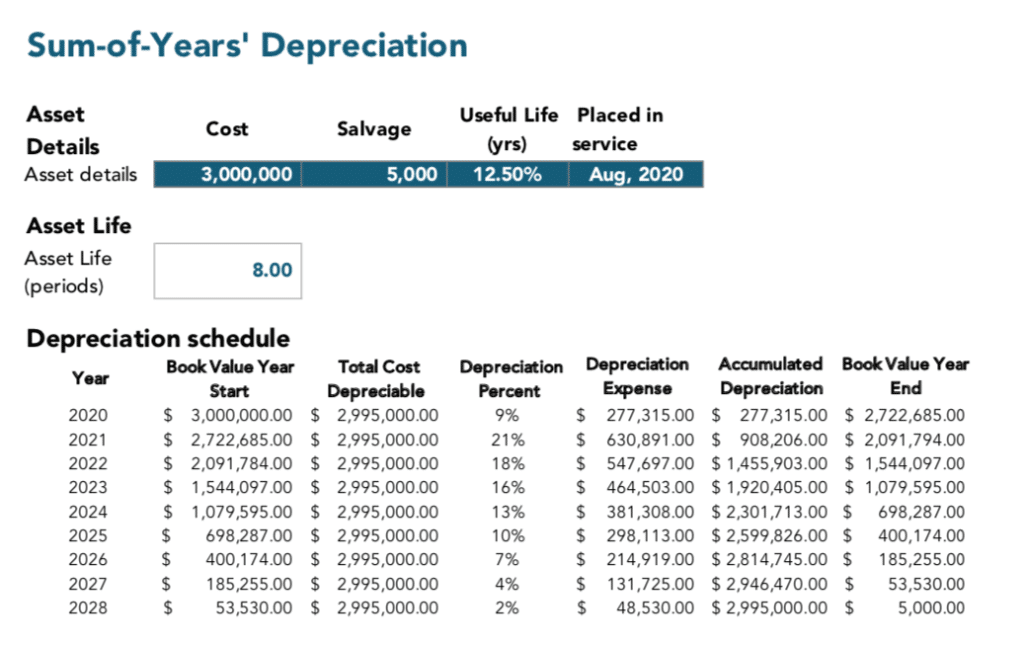

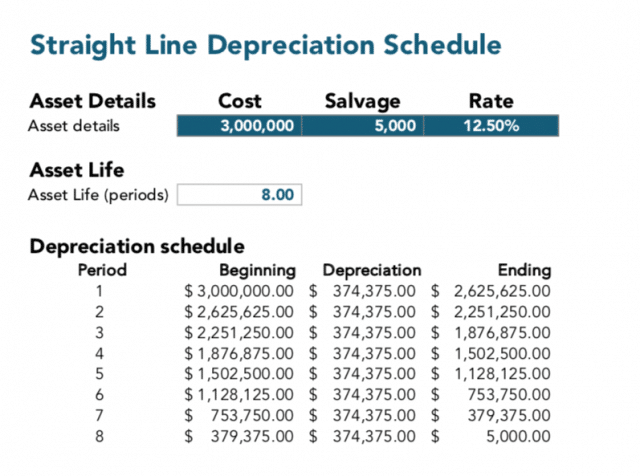

Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. How do I calculate depreciation percentage. Duke calculates and reports depreciation in.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. At depre123 try out our Free Depreciation Calculator and check out our cloud based fixed assets application. The straight line calculation as the name suggests is a straight line drop in asset value.

Jones provides an update on quarterly activities as well as his reflections on FASB activities and priorities including stakeholder outreach. Amortization or depreciation as it is sometimes still called is the decrease in resell value of assets incurred as a side effect of their use in business operations. 7000 x 30 percent 2 100.

Posted in News Tagged Bassets Depre123 Depreciation. Depreciation is an allocation of the cost of tangible property over its estimated useful life in a systematic and rational manner. Ad QuickBooks Financial Software For Businesses.

Browsing by Topic Searching and Go To navigation. Various Printing options including printer-friendly utility for viewing source references. 25 Off Select CCH Publications With Our Books Sale.

Last year depreciation 12 - M. Year 5 works a little differently. Professional ViewWhat You Get.

Under GAAP its important. FASB GAAP software for Loans and Bonds. Ad Understand GAAP Literature In A Clear Language.

The Financial Accounting Standards Board FASB structured in 1973 with auditors taking a primary role in establishing accounting principles is the authority in creating. 3430 x 30 percent 1029. 2021 GAAP Financial Reporting Taxonomy.

FASB Response to COVID-19. The depreciation of an asset is spread evenly across the life. Available In Print Or Digital.

These reports including the. Cross Reference report and archive to locate and access legacy standards. The 2021 GAAP Financial Reporting Taxonomy GRT contains updates for accounting standards and other improvements since the 2020.

In accounting the portion of equipment that is used up every year is represented by depreciation which is a way to capture the cost of normal production use for equipment or. The 2022 GAAP Financial Reporting Taxonomy GRT contains updates for accounting standards and other improvements since the 2021 Taxonomy as used by issuers filing with the US. Consistent with current Generally Accepted Accounting Principles GAAP the recognition measurement and presentation of expenses and cash flows arising from a lease by a lessee.

Accounting for the Tax Cuts and Jobs Act. How to Calculate Salvage Value. 25 Off Select CCH Publications With Our Books Sale.

Available In Print Or Digital. Guidance For Major Standards. Ad Understand GAAP Literature In A Clear Language.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. Distinguishing Liabilities from Equity. Calculate hundreds thousands of records at the same time.

Standards Guidance The FASAB Handbook of Accounting Standards and Other Pronouncements as Amended Current Handbookan approximate 2500-page PDFis the. Rated The 1 Accounting Solution. 4900 x 30 percent 1470.

Pending Content System for filtering pending content display based on user profile. Rated The 1 Accounting Solution. FASB Chair Richard R.

Accounting Principles 12th Edition Ch10

Leasehold Improvement Gaap Accounting Depreciation Write Off Efm

Limited Liability Companies Statement Of Financial Position Limited Liability Company Financial Position Financial

Gasb 87 Calculation And Accounting Example Part 2 Nakisa

The Facts And Figures Of Aircraft Depreciation

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

How To Calculate Depreciation Expense For Business

Salvage Value Accounting Formula And Example Calculation Excel Template

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

The Facts And Figures Of Aircraft Depreciation

11 3 Explain And Apply Depreciation Methods To Allocate Capitalized Costs Business Libretexts

Salvage Value Accounting Formula And Example Calculation Excel Template

/depreciation---next-exit-road-524033056-0b86e2273334483db73ed6c98384339a.jpg)

Depreciation Definition

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation What Method To Choose And Is None An Option

The Facts And Figures Of Aircraft Depreciation

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition